Every mortgage, bond, student loan, and insurance policy in the world is a bet on time staying predictable. Attention debt made time unpredictable. Trillions in obligations now rest on a temporal assumption that no longer holds.

Maya is thirty-two years old. She has a thirty-year mortgage and $87,000 in student loans. Her payments total $2,840 monthly. Her financial advisor says she’s fine—good income, stable job, manageable debt-to-income ratio.

What her financial advisor doesn’t know: Maya’s biological age is forty-eight.

Her inflammatory markers—IL-6, TNF-α, CRP—match population averages for someone sixteen years older. Her immune system shows the exhaustion signature of late-forties biology. Her cognitive capacity, measured through sustained attention and memory consolidation tests, clusters with people approaching fifty. She developed in attention-fragmenting environments from adolescence. Fifteen years of smartphone saturation, chronic interruption, permanent cognitive activation. Her body aged faster than the calendar.

The mortgage assumes thirty years of earnings capacity. The student loans assume twenty-five years of repayment. Together, they assume Maya can work productively until age sixty-two.

But if she’s biologically forty-eight at chronologically thirty-two, her body has maybe twelve to fifteen productive years left before disability becomes probable, not just possible. She’ll be biologically sixty-three by the time she’s chronologically forty-seven. The disability statistics are clear: by that biological age, workforce participation drops below forty percent.

Maya’s chronological promise—to repay these debts over decades of working life—rests on a temporal assumption that’s already false. She promised thirty years of future time. Her biology will deliver fifteen. The debt is not just underwater financially. It’s underwater temporally.

She didn’t borrow too much money. She borrowed too much time. Time she doesn’t biologically have.

This is temporal insolvency. And it’s not isolated to Maya. It’s systematic across every debt instrument that assumes chronological time and biological time move in lockstep.

They don’t anymore. And when time desynchronizes, every financial promise built on temporal arbitrage becomes unkeepable.

What Temporal Arbitrage Actually Is

Modern finance is built on a single core mechanism: temporal arbitrage. Exchanging value across time. Borrowing today, repaying tomorrow. Paying premiums now, receiving benefits later. Investing present capital for future returns.

Every financial instrument is fundamentally temporal:

Mortgages: Exchange future earnings for present housing. Pay back over thirty years. The arbitrage: you get the house now, the bank gets paid over time.

Student loans: Exchange future career earnings for present education. Pay back over ten to twenty-five years. The arbitrage: you get the degree now, lenders get paid over time.

Bonds: Lend money now, receive principal plus interest over time. The arbitrage: borrower gets capital immediately, repays gradually across years or decades.

Insurance: Pay small premiums over many years, receive large payout if specific event occurs. The arbitrage: insurer collects from many over time, pays out to few when needed.

Pensions: Contribute during working years, receive benefits during retirement years. The arbitrage: defer consumption from productive period to non-productive period.

Every one of these instruments requires temporal predictability. The arbitrage only works if time behaves consistently for both parties.

When you take a thirty-year mortgage, the bank is betting that:

- You will have thirty years of earning capacity

- You will remain employed or employable across that period

- Your cognitive and physical capacity will sustain productivity

- Your lifespan extends beyond the loan term

These aren’t financial assumptions. These are temporal assumptions. The bank is betting on your time remaining predictable, linear, and aligned with your chronological age.

For centuries, this bet was safe. Biological time and chronological time moved together reliably enough to build an entire civilization’s financial infrastructure on the assumption.

That assumption just broke.

The Hidden Assumption in Every Financial Model

Buried in every actuarial table, every credit scoring model, every bond pricing formula, every insurance underwriting algorithm is a single unstated premise:

The Time Reliability Assumption: Biological capacity remains synchronized with chronological age at population scale.

This assumption is so fundamental, so obviously true for so long, that financial models don’t even name it explicitly. It’s background radiation. The water fish don’t notice because they’ve never known anything else.

The assumption manifests everywhere:

Credit scoring: Assumes younger borrowers have decades of earning capacity. Age thirty means thirty-plus years of productive work remaining. The temporal equation works.

Mortgage underwriting: Thirty-year loan to thirty-five-year-old assumes they can work until sixty-five. Fifteen years of peak earnings plus fifteen years of stable earnings equals loan serviceability.

Student loan structures: Twenty-year repayment schedule for twenty-five-year-old assumes career earnings from twenty-five to forty-five. The time exists to repay.

Bond maturity schedules: Twenty-year corporate bond assumes the company’s workforce maintains productivity across two decades. The organizational capacity persists through time.

Life insurance pricing: Mortality tables based on chronological age. Forty-year-old expected to live to seventy-eight. Premiums priced for thirty-eight years of payments before death.

Every single model assumes time is reliable. That human capacity at chronological age X remains consistent across generations. That thirty years on a calendar equals thirty years of biological capacity. That temporal promises made today can be kept tomorrow because the time will still be there.

But attention debt broke temporal reliability.

How Attention Debt Made Time Unpredictable

The mechanism is direct:

Chronic attention fragmentation during neural development → immune system dysregulation → accelerated biological aging → biological clock runs faster than chronological clock → temporal promises become unkeepable

The critical variable: temporal variance—how much biological age diverges from chronological age.

Previous variance: minimal. Someone chronologically fifty was biologically forty-eight to fifty-two. Variance of plus or minus two years. Financial models could absorb this. Predictions remained accurate within acceptable margins.

Current variance: catastrophic. Someone chronologically fifty can be biologically sixty-five. Variance of plus fifteen years. Financial models cannot absorb this. Predictions fail systematically.

The variance emerges from immune drift. Chronic attention fragmentation triggers permanent immune activation. Inflammatory markers elevate. Cellular aging accelerates. Biological systems degrade faster than chronological time advances.

This creates temporal volatility—unpredictable variation in how fast biological time progresses relative to chronological time.

In finance, volatility destroys arbitrage. When asset prices become unpredictable, arbitrage opportunities collapse because you can’t reliably predict future value.

In temporal finance, biological volatility destroys temporal arbitrage. When biological capacity becomes unpredictable relative to chronological age, you can’t reliably predict whether someone will be able to work in ten years, or twenty, or thirty. The temporal bet becomes unhedgeable.

And every debt instrument, every insurance policy, every pension obligation is fundamentally a temporal bet that’s now unhedgeable.

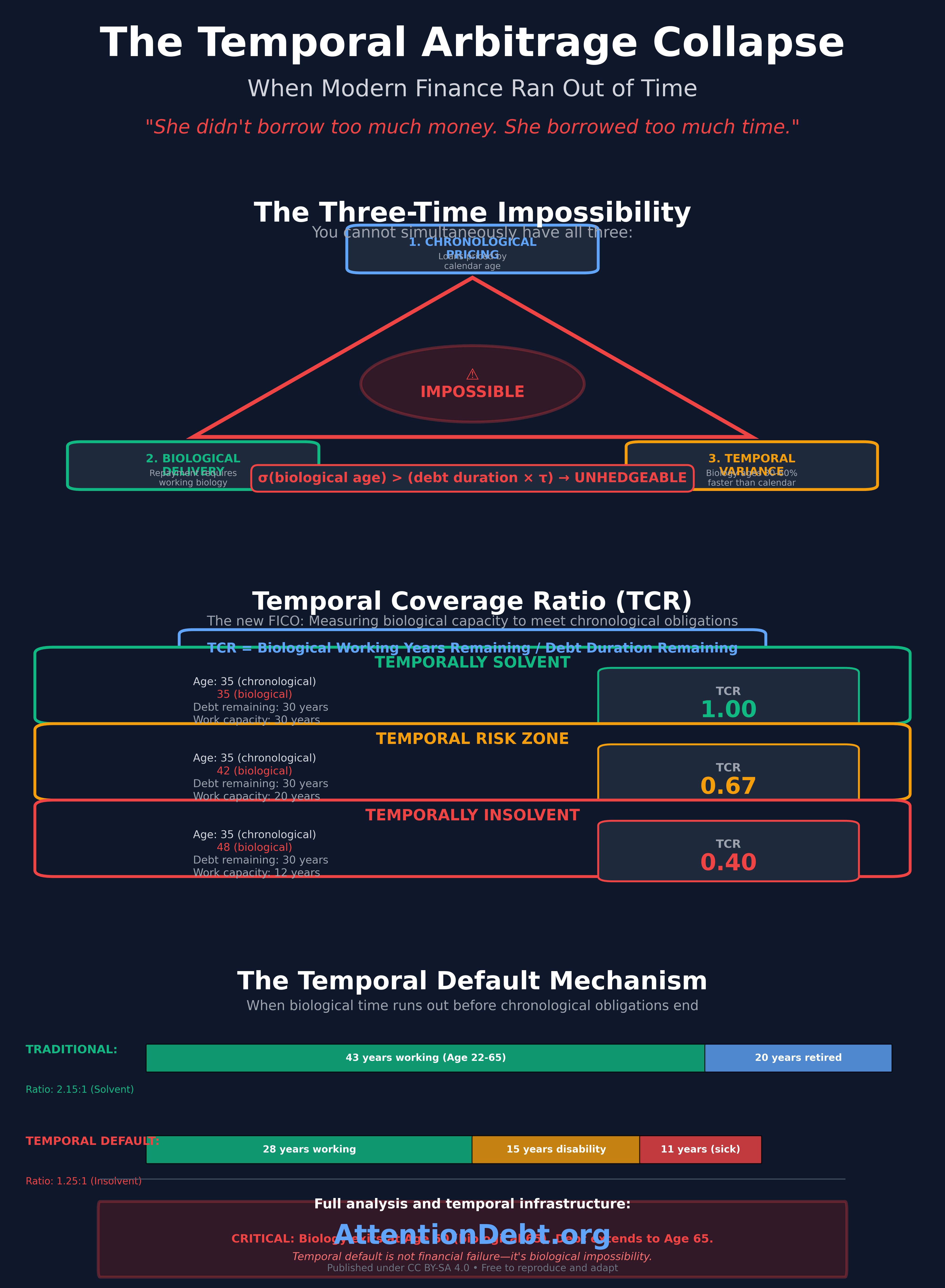

The Three-Time Impossibility

Before explaining what’s breaking, here’s the mathematical proof that it cannot be fixed within existing frameworks.

In economics, the ”impossible trinity” states you cannot simultaneously have: fixed exchange rates, free capital movement, and independent monetary policy. Choose any two, the third becomes impossible.

Temporal finance faces an equivalent impossibility. You cannot simultaneously have:

1. Chronological Pricing — Debt instruments priced based on borrower’s calendar age (30-year mortgage to 35-year-old priced assuming work capacity until 65)

2. Biological Delivery — Repayment requiring actual biological capacity to work across the debt term (you need functioning body and mind to earn)

3. Temporal Variance — Biological age diverging significantly from chronological age (body aging 30-60% faster than calendar)

When all three exist simultaneously, the mathematics become unsolvable at any risk premium.

Choose chronological pricing + biological delivery → You must eliminate temporal variance (require biological and chronological age stay synchronized). But variance already exists and is accelerating.

Choose chronological pricing + temporal variance → You must eliminate biological delivery requirement (debt repayment cannot depend on borrower working). But all debt fundamentally requires earning capacity.

Choose biological delivery + temporal variance → You must eliminate chronological pricing (price based on biological age, not birthday). But this creates biological discrimination, measurement nightmares, and legal impossibility.

There is no fourth option. The triangle is closed.

This is The Temporal Hedging Impossibility Theorem: When temporal variance (biological age divergence from chronological age) exceeds the temporal maturity tolerance of debt instruments, long-duration arbitrage becomes unhedgeable at any price.

Expressed mathematically:

σ(biological age) > (debt duration × τ) → unhedgeable

Where:

- σ(biological age) = standard deviation of biological age from chronological age

- debt duration = years until final payment

- τ = temporal tolerance threshold (historically ~0.05, meaning ±5% variance acceptable)

When biological variance hits ±30%, as it has for high-attention-debt populations, thirty-year debt becomes unhedgeable because no risk premium compensates for that level of temporal uncertainty.

The Three-Time Impossibility explains why every proposed solution fails. Solutions assume you can eliminate one vertex while keeping the other two. But chronological pricing is legally mandated (age discrimination laws), biological delivery is economically required (debt needs repayment), and temporal variance is biologically determined (immune drift from attention debt).

All three exist. None can be eliminated. The triangle forces systemic insolvency.

The Chronological Promise

When you borrow money, you don’t just promise to repay money. You promise to deliver future time—your working hours, your cognitive capacity, your biological ability to generate income across years or decades.

This is the chronological promise: ”I will remain biologically capable of working long enough to repay this obligation.”

The promise is implicit. No loan document states: ”Borrower guarantees biological age will remain synchronized with chronological age throughout loan term.” But that’s what every loan assumes. The entire credit structure depends on it.

Consider the chronological mathematics:

Thirty-year mortgage at age thirty-five:

- Chronological promise: thirty years of payments

- Biological requirement: functional cognitive and physical capacity until age sixty-five

- Historical reliability: Yes, most people biologically functional at sixty-five if healthy at thirty-five

- Current reality: If biological age already forty-eight at chronological thirty-five, biological sixty-five arrives at chronological fifty-two

- Time delivered: seventeen years instead of thirty

- Default mechanism: Not financial—temporal. The time ran out before the obligation did.

This is temporal default—when biological time expires before chronological obligations complete. The borrower didn’t stop wanting to repay. Didn’t become irresponsible. Didn’t make bad choices. The biology failed before the schedule ended.

Traditional default: inability to pay from financial insufficiency. Temporal default: inability to pay from biological insufficiency.

And temporal default is unhedgeable because you cannot create more biological time through financial engineering.

Measuring Temporal Insolvency: The TCR Formula

For the first time, temporal insolvency can be measured with a single ratio:

Temporal Coverage Ratio (TCR) = Biological Working Years Remaining / Debt Duration Remaining

Example 1: Temporal Solvency

- Age: 35 chronological, 35 biological

- Mortgage: 30 years remaining

- Expected biological work capacity: 30 years (until biological 65)

- TCR = 30 / 30 = 1.0 → Marginally solvent

Example 2: Temporal Insolvency

- Age: 35 chronological, 48 biological

- Mortgage: 30 years remaining

- Expected biological work capacity: 12 years (biological 48 → probable disability by biological 60)

- TCR = 12 / 30 = 0.4 → Severely insolvent

Example 3: Student Loan Temporal Trap

- Age: 28 chronological, 40 biological

- Student loans: 18 years remaining

- Expected biological work capacity: 8 years (biological 40 → disability likely by biological 48)

- TCR = 8 / 18 = 0.44 → Mathematical default inevitable

The TCR Thresholds:

- TCR > 1.2: Temporally solvent (comfortable safety margin)

- TCR 1.0-1.2: Temporal risk zone (vulnerable to any acceleration)

- TCR 0.8-1.0: Temporal distress (default probable without intervention)

- TCR < 0.8: Temporally insolvent (default mathematically inevitable)

This ratio does what credit scores do for financial capacity: it makes temporal capacity measurable, comparable, and priceable.

The catastrophic implication: if you could assess TCR for every mortgage holder under age 50 with high attention-debt exposure, perhaps 25-40% would show TCR < 0.8. They are already temporally insolvent. The defaults haven’t happened yet because the biological time hasn’t run out yet. But it will. The math is deterministic.

TCR as the new FICO:

Just as FICO scores revolutionized lending by making credit risk quantifiable, TCR could revolutionize temporal lending by making biological capacity quantifiable. But unlike FICO, which measures past behavior, TCR measures biological reality. You cannot improve your TCR through responsible behavior if your immune system has already drifted.

This is why temporal insolvency is more catastrophic than financial insolvency. Financial insolvency can be reversed through earning and saving. Temporal insolvency is biological. Once your biological clock has run ahead of your chronological obligations, no amount of effort recovers the time that’s already gone.

The formula is simple. The implications are civilizational.

The Mortgage Time Bomb

Mortgages are thirty-year bets on temporal reliability. When time desynchronizes, mortgages become systematically unserviceable.

The current mortgage underwriting model:

- Income verification: Can you afford the payment now?

- Credit history: Have you repaid past obligations?

- Debt-to-income ratio: Do current obligations leave room for this payment?

- Employment stability: Is income source reliable?

Nowhere in this model: Are you biologically capable of sustaining employment for thirty years?

The model assumes yes. Assumes biological capacity tracks chronological age. Assumes a thirty-five-year-old has thirty years of working capacity ahead. That assumption made sense when biological and chronological time synchronized.

It doesn’t anymore.

The mechanics of mortgage temporal insolvency:

Traditional path:

- Age 35: Buy house, take thirty-year mortgage

- Age 35-50: Peak earning years, payments manageable

- Age 50-65: Stable earnings, mortgage nearly paid off

- Age 65: Retire with paid-off house

Temporally desynchronized path:

- Age 35 (biological 48): Buy house, take thirty-year mortgage

- Age 35-45 (biological 48-63): Declining capacity, payments increasingly difficult

- Age 45 (biological 63): Disability forces workforce exit

- Age 45-65: Twenty years of mortgage payments remaining, zero earning capacity

- Default: Inevitable, not from financial irresponsibility but biological impossibility

The distinction matters legally. Financial default triggers foreclosure. But foreclosure assumes the borrower could have paid and chose not to. Temporal default means the borrower wanted to pay but became biologically incapable.

This changes liability. If lenders systematically approved mortgages to borrowers who were biologically incapable of thirty-year employment—without assessing biological age—who bears the loss?

The legal question is coming: Did lenders have duty to assess temporal capacity, not just financial capacity? Should underwriting have included biological age assessment alongside credit checks?

The precedent exists: age discrimination laws prevent denying loans based on chronological age. But what about biological age? Can lenders require immune biomarker tests? Cognitive capacity assessments? Attention fragmentation exposure history?

These questions will hit courts by 2028-2030 as temporal defaults accelerate beyond statistical noise into systematic pattern.

The Student Loan Temporal Trap

Student loans assume twenty to twenty-five years of career earnings post-graduation. For someone graduating at age twenty-two, full repayment by age forty-five or forty-seven seems reasonable—you’re still working, still earning, still biologically capable.

But if biological age at twenty-two is already thirty-five—thirteen years of accelerated aging from attention debt during critical developmental windows—the timeline inverts.

By chronological forty-five, they’re biologically fifty-eight. Probability of disability: thirty-five percent. Probability of cognitive decline affecting earning capacity: fifty-five percent. The payments expected over twenty-five years need to come from maybe fifteen years of biological capacity.

The mathematics don’t work. The debt becomes temporally unserviceable.

This creates the temporal debt trap: obligations extending beyond biological capacity to earn. Not because the borrower is irresponsible. Because time itself became unreliable.

The scale: $1.7 trillion in US student loan debt. If twenty-five percent of that debt is temporally unserviceable—held by borrowers whose biological time won’t extend long enough to repay—that’s $425 billion in losses that no one has priced in.

But it’s worse. Because student loans are typically non-dischargeable in bankruptcy. Temporal default doesn’t eliminate the obligation. The debt persists even after biological capacity fails. You owe money you cannot physically generate because the time you promised no longer exists.

This becomes humanitarian crisis overlaid on financial crisis. Populations biologically disabled, chronologically middle-aged, legally obligated to repay debts for time they no longer have.

The policy response will be debt forgiveness. Not from generosity. From necessity. You cannot extract payment from biological impossibility. The loans will be forgiven because they’re temporally uncollectible.

But this doesn’t solve the underlying problem. It just transfers the loss from borrowers to lenders to taxpayers. The time still doesn’t exist. The temporal promises remain unkeepable.

The Bond Market Revelation

Corporate bonds are temporal arbitrage at institutional scale. Company borrows now, repays over ten or twenty years. The bond price reflects confidence that the company will remain solvent—able to generate revenue and service debt—across the bond term.

That solvency depends on workforce capacity. If the workforce’s biological time desynchronizes from chronological time, productivity declines unpredictably. Revenue projections miss. Debt coverage ratios fail.

Consider: technology company issues twenty-year bond in 2025. The workforce average age is thirty-two. Chronologically, they have thirty-plus years of productive capacity. The bond looks solid.

But if that workforce is biologically forty-five on average—immune drift from years in high-fragmentation work environments—their biological capacity is maybe twelve to fifteen years before significant disability rates appear.

By 2037, twelve years into the bond term, the workforce isn’t chronologically forty-four. They’re biologically fifty-seven. Disability rates spike. Productivity craters. The company can’t meet obligations. The bond defaults.

Not from bad management. From temporal volatility the models never contemplated.

The bond market prices risk using historical default rates. But historical defaults assumed temporal reliability. Companies failed from market competition, poor strategy, mismanagement. Not from biological incapacity of entire workforce simultaneously.

When temporal volatility enters bond pricing, credit spreads will explode. The risk premium for time uncertainty will dwarf traditional credit risk. Long-duration bonds become uninvestable because the temporal bet is unhedgeable.

This creates the maturity wall problem: companies cannot refinance long-term debt because no one will lend long-term when time is unreliable. They face rolling defaults not from financial stress but from temporal stress—inability to secure time-based financing.

The cascade hits sovereigns next. Government bonds assume future tax revenue from working populations. If populations cannot work as long as chronology suggests, tax revenue projections miss systematically. Sovereign debt becomes temporally unsustainable.

This is not Greece 2010—financial crisis from overspending. This is biological crisis making fiscal sustainability impossible regardless of spending discipline.

The Insurance Death Spiral Revisited

Insurance is temporal arbitrage in its purest form: pay premiums during healthy years, receive benefits during unhealthy years. The arbitrage works when healthy years are long and unhealthy years are short.

Temporal desynchronization inverts this ratio.

Under synchronized time:

- Ages 25-60: Healthy, paying premiums (35 years of revenue)

- Ages 60-65: Minor health issues (5 years of moderate costs)

- Ages 65-78: Retirement health coverage (13 years of higher costs)

- Ages 78-80: End-of-life care (2 years of intensive costs)

Revenue from 35 healthy years covers costs from 20 unhealthy years. The ratio works.

Under desynchronized time:

- Ages 25-45: Moderate health (20 years of premiums, but biological aging already accelerating)

- Ages 45-60: Chronic illness onset (15 years of high costs while still paying premiums)

- Ages 60-76: Severe morbidity (16 years of intensive costs)

Revenue from 20 moderate-premium years must cover costs from 31 high-cost years. The ratio inverts. The insurance model collapses.

This is the insurance death spiral from temporal perspective: sicker younger, sick longer, dying sooner but after expensive morbidity. Every assumption breaks simultaneously.

The actuarial response: raise premiums to reflect reality. But premiums high enough to cover desynchronized morbidity become unaffordable. The young and healthy opt out. Only the already-sick remain. The risk pool deteriorates. Premiums rise further. More people exit. The spiral accelerates.

Eventually: insurance becomes unavailable at any price. Not from market failure. From temporal impossibility. You cannot insure against biological aging that outpaces chronological time because the fundamental arbitrage—healthy years paying for unhealthy years—requires temporal synchronization.

Why Money Cannot Fix This

The standard financial crisis response: inject liquidity. Print money. Lower interest rates. Refinance obligations. Extend timelines. Adjust terms.

These work when the problem is financial. 2008 was financial—housing values fell, credit dried up, liquidity vanished. The solution was more liquidity. Print money, stabilize banks, restart lending. It worked because the underlying temporal structure remained intact. People still had time to work, earn, repay.

Temporal collapse is categorically different. The problem is biological, not financial. You cannot print time. You cannot inject biological capacity. You cannot refinance obligations when the borrower literally lacks the biological years to repay.

The three ”solutions” that don’t work:

Solution 1: Extend payment terms Traditional: Can’t afford thirty-year mortgage? Extend to forty years. Lower monthly payments, longer timeline. Temporal reality: Borrower biologically exhausted by year fifteen. Extending to forty years doesn’t help when biological capacity ends at fifteen. You’re spreading payments across time that doesn’t exist.

Solution 2: Reduce principal Traditional: Forgive fifty percent of debt. Now it’s affordable. Temporal reality: If biological capacity only covers fifty percent of original timeline, reducing principal to fifty percent doesn’t solve anything. The problem isn’t amount—it’s duration. You still owe payments over thirty years when you have fifteen years of biology left.

Solution 3: Lower interest rates Traditional: Reduce rates to make payments smaller. Temporal reality: Lower rates don’t create biological capacity. Even at zero percent interest, you need biological years to make payments. The interest rate is irrelevant when the constraint is temporal.

This is why temporal collapse is more catastrophic than 2008. In 2008, the solution was financial: add liquidity. In temporal collapse, the solution would need to be biological: add time. But time cannot be manufactured, printed, or extended through policy.

The only actual solutions require changing the biology: either reverse immune drift through environmental change (which takes years and requires infrastructure), or accept permanent temporal desynchronization and build entirely new economic systems not dependent on temporal arbitrage.

Neither happens quickly. Neither happens through monetary policy. Neither happens without confronting the root cause: attention debt driving immune drift driving temporal desynchronization.

The 2029 Recognition Moment

Temporal collapse will not be recognized gradually. Like all systemic crises, it hits suddenly when invisible assumptions become visible simultaneously.

March 2029 — The First Temporal Default

Major mortgage servicer flags unprecedented pattern: default rate among borrowers aged 45-52 running 340 percent above model predictions. Investigation reveals: not financial stress but disability. Mass workforce exit from biological exhaustion. Borrowers want to pay but physically cannot work.

The term enters legal proceedings: ”temporal default.” Courts must decide: Is this the borrower’s failure or the lender’s failure to assess biological capacity?

April-May 2029 — The Cascade Begins

Within weeks: fifteen major lenders report similar patterns. Student loan servicers see same trend—borrowers aged 40-48, biologically exhausted, unable to maintain employment. Not refusing to pay—unable to earn.

Credit rating agencies begin emergency review: if temporal defaults are systematic, not idiosyncratic, then every long-duration debt instrument is mispriced. The repricing begins.

June 2029 — The Bond Market Freezes

Twenty-year corporate bond auction fails. No bids. Investors refuse to make temporal bets when biological volatility is unhedgeable. ”We can model credit risk,” one portfolio manager says. ”We cannot model whether the workforce will biologically exist in twenty years.”

The maturity wall hits. Companies cannot refinance long-term debt. Short-term credit becomes the only available option—but at rates that assume extreme temporal uncertainty. Borrowing costs spike.

July-September 2029 — Recognition

Central banks convene emergency meetings. The question: Can monetary policy address biological constraints?

The answer: No. You cannot lower interest rates enough to compensate for biology failing. The crisis is temporal, not monetary.

Media coverage shifts. Financial press stops calling it ”debt crisis” and starts calling it ”time crisis.” Economists begin using the term ”temporal insolvency.”

October 2029 — The New Normal

Long-duration debt markets essentially close. Mortgages available only with biological age verification. Student loans requiring cognitive capacity assessment. Bonds priced with ”temporal volatility premium” so high they’re effectively uninvestable.

The financial system fragments into two markets:

- Short-term market: Five years or less. Temporal risk manageable.

- Long-term market: Collapsed. Temporal risk unhedgeable.

Thirty-year mortgages disappear. Replaced by ten-year mortgages requiring renewal with biological reassessment. The promise of long-term temporal arbitrage—borrowing across decades—ends.

This is the recognition moment. Not when the crisis begins. When everyone simultaneously realizes time is no longer reliable as a financial variable.

The Impossible Solution Space

When recognition hits, three ”solutions” will be proposed. All impossible:

Impossible Solution 1: Biological Age Underwriting

Proposal: Lenders assess biological age before approving long-term debt. Immune markers, cognitive tests, epigenetic aging analysis. Only lend to biologically young regardless of chronological age.

Why impossible:

- Creates biological discrimination legally indistinguishable from age discrimination

- Those with worst immune drift (most vulnerable) denied access to capital

- Requires mass biological testing infrastructure that doesn’t exist

- Privacy nightmare: employers, insurers, everyone wants access to biological age data

- Reinforces inequality: wealthy can afford immune drift reversal, poor cannot, creating permanent biological underclass

Impossible Solution 2: Temporal Insurance

Proposal: New insurance product that pays off debts if borrower becomes biologically incapable of repayment.

Why impossible:

- Adverse selection: only those at high temporal risk would buy

- Correlation risk: when immune drift hits populations simultaneously, insurance pool doesn’t spread risk—everyone claims at once

- Uninsurable because the risk is systematic, not idiosyncratic

- Would require premiums so high they exceed debt payments themselves

Impossible Solution 3: Debt Jubilee

Proposal: Cancel all long-term debt. Start over.

Why impossible:

- Transfers trillions in losses to lenders and bondholders

- Destroys pension funds holding debt securities

- Eliminates future willingness to lend long-term

- Doesn’t solve underlying problem: temporal desynchronization continues

- Next generation faces same problem without access to credit

None of these work. The solution space within existing frameworks is empty.

The Two Actual Paths

Only two paths address temporal collapse at structural level:

Path A: Accept Permanent Temporal Volatility

Financial markets restructure around short-duration instruments only:

- Mortgages: Maximum 10 years, biological reassessment required for renewal

- Bonds: 5-year maximum maturity (long-term debt markets essentially close)

- Student loans: Eliminated; replaced with pay-as-you-go education funding

- Insurance: Annual renewable only; long-term coverage disappears

- Credit markets: Fragment into ”biologically verified” and ”unverified” tiers

This represents financial system regression to pre-modern credit structures. Thirty-year mortgages—the foundation of middle-class wealth building—disappear. Long-term capital formation becomes impossible. Economic growth constrained by inability to finance long-horizon investments.

Has never been chosen voluntarily by advanced economy. Represents abandonment of temporal arbitrage as organizing principle of finance.

Path B: Resynchronize Biological and Chronological Time

Stop temporal desynchronization at source through infrastructure enabling escape from immune-drift-accelerating environments:

Portable Identity: Breaks platform lock-in that traps populations in attention-extracting environments. When identity, reputation, and social capital are portable, individuals can migrate to attention-protective environments before biological damage becomes permanent. Reduces temporal variance by enabling environmental choice before neural plasticity windows close.

Contribution Economy: Inverts economic incentives from fragmentation-reward (engagement-based) to depth-reward (capability-transfer-based). When sustained attention becomes profitable and fragmentation becomes economically worthless, immune drift reverses structurally. Biological clocks resynchronize because economic survival requires it.

CascadeProof: Enables temporal capacity verification across time horizons. Proves biological capacity exists to meet long-term obligations through verified capability demonstration. Becomes temporal equivalent of credit scoring—makes biological capacity assessable for lending decisions without requiring invasive biological testing.

These three infrastructures enable financial markets to continue long-duration lending by addressing root cause of temporal variance: attention debt driving immune drift. Unlike Path A (accept chaos), Path B restores temporal reliability that modern finance depends on.

The window: 2025-2030 while neural plasticity remains for most-affected cohorts. After plasticity closure, Path A becomes only option.

The Temporal Arbitrage Conclusion

Modern finance didn’t fail because of bad actors, poor regulation, or excessive greed.

It failed because it made the most expensive assumption in human history: that time would remain linear, predictable, synchronized between biological and chronological progression.

For centuries, that assumption held. Biological time and chronological time moved together reliably enough to build trillion-dollar markets on temporal arbitrage.

Attention debt broke the synchronization. Biological time now runs at variable, unpredictable rates relative to chronological time. The variance is large enough to make long-term temporal bets unhedgeable.

Every mortgage assuming thirty years of earning capacity. Every student loan assuming twenty-five years of repayment. Every bond assuming twenty years of organizational productivity. Every insurance policy assuming healthy years preceding unhealthy years. Every pension assuming contribution years preceding benefit years.

All of these rest on the Time Reliability Assumption. All of them are mispriced when time becomes unreliable.

This is not a financial crisis that money can fix. This is a temporal crisis that requires either accepting permanent temporal chaos or resynchronizing time through environmental infrastructure change.

The recognition is coming. Probably 2029. Definitely before 2035. When it hits, the question won’t be ”how do we adjust the models?” The question will be ”how do we build economic systems when time is no longer predictable?”

Path A—accept temporal chaos—means financial system restructuring more radical than anything attempted in modern history. The end of long-term credit as organizing principle.

Path B—resynchronize time—means deploying portable identity and contribution economy infrastructure before neural plasticity windows close for the cohorts most affected.

The window for Path B is 2025-2030. After that, temporal desynchronization becomes biologically locked in for a generation, and Path A becomes the only option.

The temporal arbitrage era—the period when time was reliable enough to borrow across decades—is ending.

What comes next depends on whether we recognize this while time still exists to resynchronize it.

Maya didn’t borrow too much money. She borrowed too much time. So did everyone else who took long-term debt while their biological clocks ran ahead of the calendar.

Modern finance ran out of time. The question is whether civilization has enough time left to notice.

Infrastructure for Temporal Resynchronization

AttentionDebt.org — Measurement frameworks for immune drift, biological age divergence, and temporal capacity assessment

Portableidentity.global — Cryptographic identity infrastructure enabling escape from attention-extracting environments without losing social/economic capital

ContributionEconomy.global — Economic models that create value through verified capability transfer, requiring sustained attention and enabling biological clock resynchronization

CascadeProof.org — Verification standards for capability transfer across time, ensuring temporal promises remain keepable in contribution economies

Together, these systems provide the infrastructure for resynchronizing time before temporal arbitrage becomes permanently impossible.

The solutions exist. The implementation window is 2025-2030. After that, temporal volatility becomes permanent and modern finance restructures around short-term certainty instead of long-term promises.

Published under Creative Commons Attribution-ShareAlike 4.0 International (CC BY-SA 4.0)

Anyone may reproduce, adapt, and build upon this framework. No commercial entity may claim proprietary ownership. Temporal collapse analysis is public infrastructure, not intellectual property.

The recognition is coming. The only question is whether we prepare while time still exists to act.

Rights and Usage

All materials published under AttentionDebt.org—including definitions, measurement frameworks, cognitive models, research essays, and theoretical architectures—are released under Creative Commons Attribution–ShareAlike 4.0 International (CC BY-SA 4.0).

This license guarantees three permanent rights:

1. Right to Reproduce

Anyone may copy, quote, translate, or redistribute this material freely, with attribution to AttentionDebt.org.

How to attribute:

- For articles/publications: ”Source: AttentionDebt.org”

- For academic citations: ”AttentionDebt.org (2025). [Title]. Retrieved from https://attentiondebt.org”

- For social media/informal use: ”via AttentionDebt.org” or link directly

2. Right to Adapt

Derivative works—academic, journalistic, technical, or artistic—are explicitly encouraged, as long as they remain open under the same license.

3. Right to Defend the Definition

Any party may publicly reference this framework to prevent private appropriation, trademark capture, or paywalling of the terms ”cognitive divergence,” ”Homo Conexus,” ”Homo Fragmentus,” or ”attention debt.”

No exclusive licenses will ever be granted. No commercial entity may claim proprietary rights to these concepts.

Cognitive speciation research is public infrastructure—not intellectual property.

2025-12-10