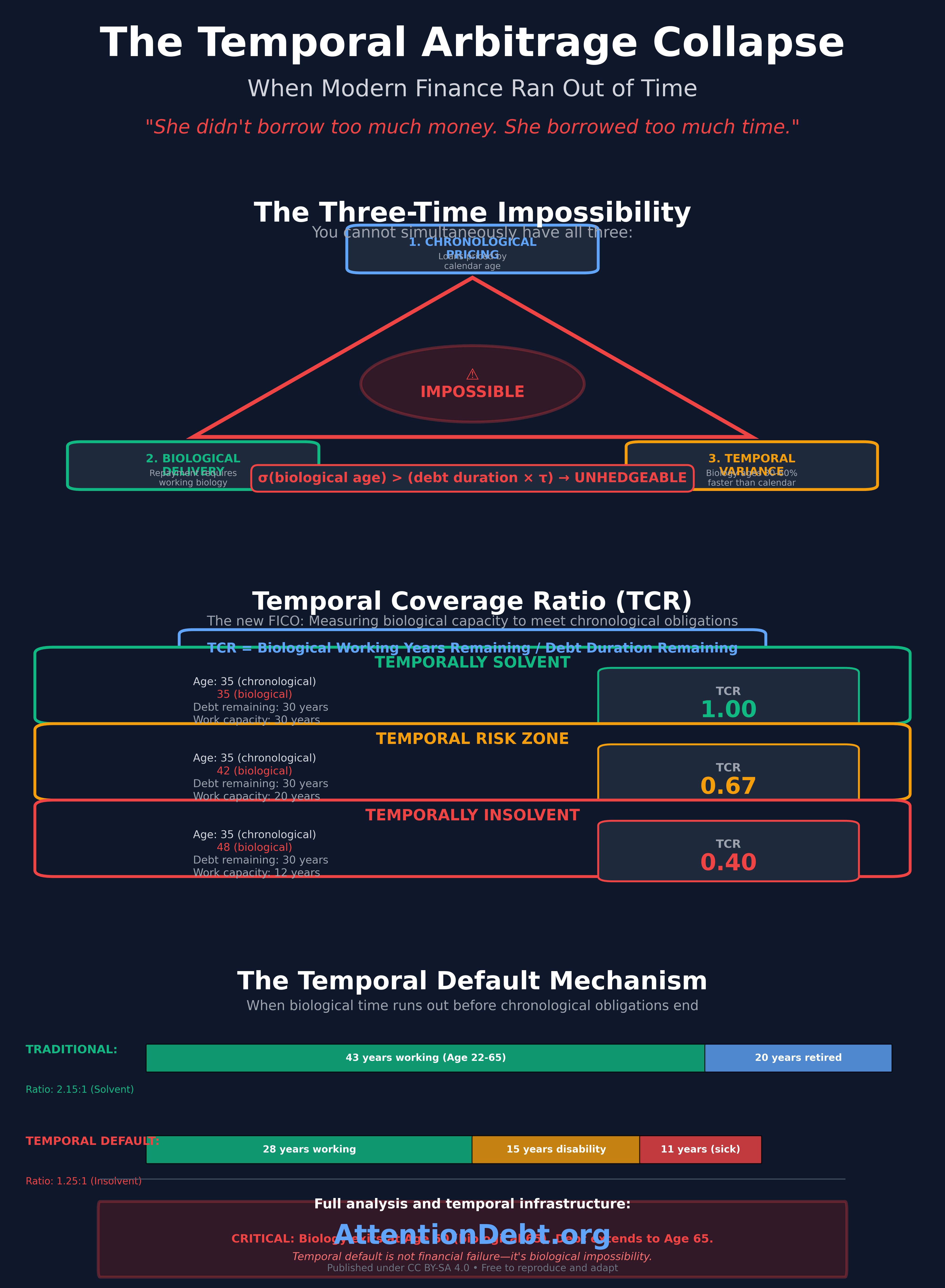

The Temporal Arbitrage Collapse: When Modern Finance Ran Out of Time

Every mortgage, bond, student loan, and insurance policy in the world is a bet on time staying predictable. Attention debt made time unpredictable. Trillions in obligations now rest on a temporal assumption that no longer holds. Maya is thirty-two years old. She has a thirty-year mortgage and $87,000 in student loans. Her payments total $2,840 … The Temporal Arbitrage Collapse: When Modern Finance Ran Out of Time