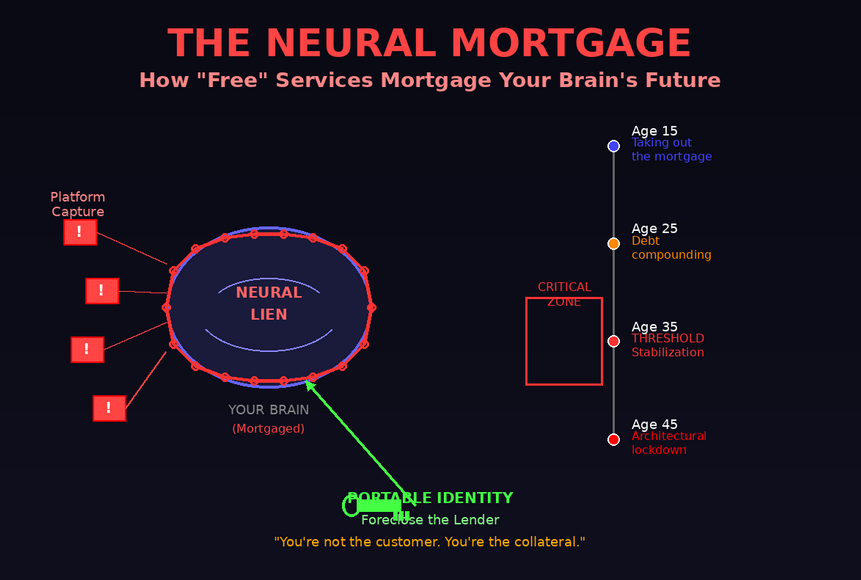

The Neural Mortgage: How ”Free” Services Are Mortgaging Your Brain’s Future (And Why the Bill Comes Due at 35)

You think you’re getting free email, free social networking, free entertainment.

You’re not.

You’re taking out a mortgage on your brain’s future. And at age 35, the bank comes to collect.

Not in money. In something far more valuable: your capacity to think, focus, create, and be present. The currency of this mortgage is neural plasticity itself. And unlike financial mortgages where you eventually own the house, this mortgage ends with the bank owning you.

Welcome to the neural mortgage economy. Where platforms aren’t businesses—they’re neural banks. Where your attention isn’t the product—it’s the collateral. Where ”free” isn’t a business model—it’s a foreclosure strategy.

And where the contract you signed at 15 comes due at 35, when your brain loses the biological capacity to escape.

This isn’t metaphor. This is mechanism. And it’s happening right now, to billions of people who think they’re just checking their phone.

The Mortgage You Didn’t Sign

Every financial mortgage has the same basic structure: borrow money you don’t have now, pay it back over time with interest, eventually own the asset.

Neural mortgages work differently. And far more viciously.

You’re not borrowing attention you don’t have. You’re giving away attention you do have—right now, irreversibly—in exchange for services that feel free but extract compound interest on your future cognitive capacity.

The structure:

Traditional mortgage: Borrow money → Pay with future earnings → Eventually debt-free and own asset

Neural mortgage: Use ”free” service → Pay with present attention → Accumulate neural debt → Never debt-free, never own anything, permanently cognitively captured

Here’s what makes neural mortgages uniquely predatory: the interest compounds in your brain’s physical structure. Every notification you answer strengthens the neural pathways that make you answer the next one faster. Every scroll deepens the groove that makes scrolling feel automatic. Every check trains your brain to check again.

This is not habit formation. This is neural pathway reinforcement. The difference matters. Habits can be broken with willpower. Neural pathways require biological reconsolidation. Habits are software. Neural pathways are hardware. And hardware takes time to rewire—time you don’t have once plasticity declines.

Platforms know this. They optimized for it. Not because they’re evil, but because their survival depends on it. A platform that doesn’t capture your attention loses to a platform that does. The business model selects for neural mortgage enforcement. The most ”successful” platforms are simply the ones that mortgage your cognitive future most effectively.

You’re not the customer. You’re the collateral.

The Payment Terms (Hidden in the Fine Print You Never Read)

Financial mortgages have transparent terms. Interest rate: 4.5%. Duration: 30 years. Monthly payment: visible on every statement.

Neural mortgages have no statements. No disclosure. No terms you can read. Because acknowledging the terms would make the predation visible. So instead, they hide in engagement metrics, A/B tests, and algorithmic optimization.

But the terms exist. And they’re brutal.

Payment frequency: Every time you check, scroll, or respond to a notification. Not monthly. Every few minutes, for hours per day, for years.

Interest rate: Neural pathway reinforcement. Each payment makes the next payment easier to extract. Compound neuroplasticity working against you.

Collateral: Your future attention capacity. Not what you give today—what you’ll be capable of giving (or withholding) in ten years.

Foreclosure clause: Age 35, when neural plasticity crashes and the debt becomes biologically permanent.

The mortgage starts young because young brains have the highest plasticity—meaning the longest effective mortgage term. Get someone at 15, and you have twenty years of compounding neural debt before foreclosure. Get them at 30, and you have maybe five years before their plasticity declines and they might actually escape.

This is why platforms compete most aggressively for young users. Not because teens have more money—because teens have more plasticity. They’re the prime borrowers in the neural mortgage market. Maximum term, maximum leverage, maximum lifetime value extraction.

And unlike financial mortgages, where the bank loses money if you default, neural mortgages are pure upside for the lender. Every payment you make (every check, every scroll) generates immediate revenue through ads or data. The platform profits from the transaction and from the compounding neural debt that makes future transactions easier to extract.

You pay twice. Once now, once later. The platform profits twice. Now from your engagement, later from your captivity.

The Biological Threshold: Why 35 Is When the Bank Collects

Here’s the part most people don’t know, and platforms pray you never learn:

Neural plasticity—your brain’s ability to rewire itself, form new pathways, break old patterns—declines significantly with age. Not linearly. But dramatically, with a threshold around age 35 where recovery from attention debt becomes exponentially harder.

The neuroscience is clear:

Age 0-25: Maximum plasticity. Your brain rewires easily. Neural mortgages accumulate, but they’re still reversible with effort.

Age 25-35: Declining plasticity. Recovery is still possible but requires more time, more effort, more consistency. The lag phase extends from two weeks to four weeks. But full recovery remains achievable.

Age 35-45: Plasticity shifts from fluid to structural. Neural pathways don’t calcify—they stabilize. You can still rewire, but the cost increases exponentially. What took two weeks at 25 now takes two months. Recovery remains possible, but the biological interest rate on change has increased dramatically.

Age 45+: Plasticity becomes rigid, not absent. You’re not locked forever, but rewiring costs compound. Every year the cost doubles. Stabilization and prevention become more realistic goals than full recovery.

This is the foreclosure mechanism. Not that change becomes impossible—but that the cost of change exceeds what most people can pay.

Around 35, something shifts. The compounding neural debt you’ve been accumulating for twenty years transitions from pattern to architecture. Not overnight. But across this threshold zone, your brain moves from constant reconstruction to structural stabilization. The pathways aren’t too strong to change—but changing them now requires exponentially more effort than it did at 25.

And the platform owns your attention—not as a metaphor, but as measurable neural architecture that now operates with structural momentum, below the threshold of easy conscious override.

You can refinance. You can change the patterns. But the cost has increased exponentially. The mortgage that was fluid at 25 is now architectural at 35. Not impossible to escape—but requiring levels of sustained effort that most mortgaged brains can no longer generate. You check because your brain has been architecturally shaped toward checking. You scroll because scrolling isn’t something you do anymore—it’s something that does you. Impulse has become identity. Behavior has become structure.

Around 35, this stabilization reaches a threshold. The brain transitions from constant reconstruction to architectural consolidation. Habits become structural. Patterns become personality. What was fluid becomes fixed—not unchangeable, but requiring exponentially more effort to reshape.

You pay because the neural pathways make non-payment feel like resisting gravity.

The mid-30s threshold isn’t arbitrary—it’s architectural. This is when the brain’s reconstruction phase stabilizes into structural consolidation. Not a switch that flips on your 35th birthday, but a phase transition that typically completes across the 30-40 decade. Individual variation exists—genetics, sleep, health all matter. But the trend is real, measurable, and predictable.

And platforms have optimized around it.

This is why engagement metrics don’t just measure present attention—they predict future captivity. A 25-year-old with high engagement isn’t just a valuable user now. They’re a neural mortgage that will come due at 35, ensuring a decade-plus of guaranteed future extraction with zero risk of escape.

The longer you’ve been paying, the harder it becomes to stop. Not impossible—but exponentially costlier. And past 35, for most people, the cost of change exceeds the capacity their mortgaged attention can generate. The recursion trap: you need sustained attention to recover sustained attention.

The Foreclosure Timeline: When a Generation Loses the Ability to Think

Scale this to a population and you get something that looks less like business and more like civilizational collapse.

2025-2028: The realization phase. Individual users start noticing: ”I can’t focus like I used to.” They assume it’s personal failure. It’s not. It’s neural architecture stabilizing around patterns incompatible with sustained attention.

2028-2032: The workforce crisis. Companies struggle to find employees capable of sustained deep work. Not because people lack skills, but because their neural architecture has stabilized around fragmented patterns. Deep work becomes rare. Complex problem-solving requires workarounds.

2032-2037: Economic adaptation. We increasingly decompose complex work into micro-tasks compatible with architecturally fragmented attention. We stop solving certain classes of hard problems—the ones that require two hours of sustained thought. We solve adjacent tractable problems instead.

2037-2045: Cognitive divergence. The cohort with pre-mortgage neural architecture ages out. The difference between those who stabilized with sustained attention capacity and those who didn’t becomes stark. Complexity management becomes a rare, valuable skill.

2038+: The archival recognition. We begin acknowledging sustained attention as a specialized capacity, not a universal human baseline. Like perfect pitch or photographic memory—real, but not the default.

This isn’t dystopia. This is extrapolation from current trajectories. When neural mortgages foreclose on an entire generation simultaneously, the result isn’t individual bankruptcy—it’s civilizational insolvency.

And here’s the part that makes this exponentially worse: attention bankruptcy makes you bad at recognizing you’re bankrupt. Because recognizing the problem requires sustained attention to your own cognitive patterns. Planning recovery requires holding a multi-week strategy in mind. Executing requires resisting impulses that now feel autonomic.

The very faculty you need to escape the mortgage is the faculty the mortgage destroyed.

This is why neural mortgages are self-enforcing in ways financial mortgages are not. Financial default doesn’t make you worse at earning money. But cognitive foreclosure makes you worse at recovering cognition.

The trap closes from inside.

Why Platforms Need Your Neural Mortgage (And Can’t Survive Without It)

Platforms will say: ”We’re not trying to mortgage anyone’s attention. We’re just building engaging products.”

Here’s why that’s structurally impossible:

Platform economics requires identity captivity. Without it, there is no platform—just a commodity service layer that users can leave at any time. And commodity services don’t generate trillion-dollar market caps.

The revenue model is simple: attention → ads → money. But sustained revenue requires sustained attention. And sustained attention requires something stronger than quality or utility or user preference.

It requires neural architecture that makes leaving feel painful.

This is the mortgage mechanism. Platforms don’t want you to choose them every day because they’re best. They want you to check automatically because your brain is wired that way. Choice is expensive—it means you might choose to leave. Automaticity is profitable—it means you can’t.

Every successful platform has optimized for one thing above all else: reducing the cognitive load required to engage, while increasing the cognitive cost of disengaging. Make checking feel effortless. Make not-checking feel uncomfortable. Train the brain until engagement is reflexive and withdrawal is painful.

That’s not engagement. That’s mortgage enforcement.

And it works because neural pathways don’t care about your intentions. They care about repetition. Do a thing ten thousand times and the pathway strengthens whether you want it to or not. Resist doing the thing and the discomfort you feel isn’t weakness—it’s neural withdrawal from a mortgage payment your brain has been trained to make.

The platform profits from the payment. But more importantly, they profit from the compounding debt that makes future payments automatic.

This is why platforms compete on engagement metrics, not value metrics. Value is what users get. Engagement is what platforms extract. And extraction, over time, becomes automatic—not because users love the product, but because their brains are wired to return to it.

You think you choose to check your phone. You don’t. Your neural mortgage requires the payment. And platforms have spent billions in A/B testing to ensure that requirement feels like choice.

The business model isn’t serving users. It’s mortgaging their future capacity to leave.

Portable Identity: The Foreclosure Notice Platforms Can’t Survive

Now here’s where it gets interesting. And by interesting, I mean existential for platforms.

Neural mortgages only work if identity is captive.

If you can leave a platform with your identity, value, and contribution graph intact—if you can port your social capital, your accumulated meaning, your entire digital presence to another service or protocol—then the neural mortgage becomes unenforceable.

Because the compounding value you’ve created isn’t locked behind the platform’s walls. It travels with you. The switching cost collapses. The mortgage loses its collateral.

This is what PortableID.org/global enables. Not better identity. Portable identity. Identity that moves with you across platforms, protocols, and contexts. Identity that you own, not rent. Identity that cannot be held hostage as collateral for a neural mortgage you never agreed to.

Portable Identity is the foreclosure notice. Not on you. On the platforms.

When identity becomes portable:

The neural pathways remain, but the captivity breaks. Your brain is still wired to check, but the compulsion is no longer reinforced by switching costs. You can leave. And once leaving is possible, the mortgage becomes refinanceable. You can take your identity to a service that respects attention rather than fragments it.

The platform loses collateral. Your future attention is no longer guaranteed. The neural mortgage they spent years cultivating becomes worthless because you’re no longer trapped in their system.

The revenue stream dies. Not because you stop using digital services, but because you start using services that don’t require neural mortgages for retention.

This is why Portable Identity is an existential threat to platform economics. Not because it’s better technology—because it breaks the mortgage mechanism that platform economics depends on.

Platforms will fight this. They’ll claim portability is ”too complex” or ”security risk” or ”bad for users.” They’re lying. Portability is simple—VISA proved that in payments. Security is solvable—encryption exists. And the only users harmed by portability are the ones platforms can no longer hold hostage.

What they really mean is: ”Portable Identity forecloses the neural mortgages we’ve spent two decades cultivating. And without those mortgages, we’re just commodity service providers competing on actual value instead of captivity.”

That’s not a bug. That’s the point.

The Secondary Market: How Your Neural Mortgage Gets Securitized

Here’s the truly sinister part most people never see:

Platforms aren’t just holding your neural mortgage. They’re trading it.

Your mortgaged attention—the compounding neural debt that makes your future engagement predictable and automatic—becomes an asset that platforms can monetize in secondary markets.

They call it ”lifetime value modeling” or ”engagement forecasting.” But what it really is: neural mortgage securitization.

Your attention is bundled with millions of other users into portfolios that can be sold to advertisers, data brokers, and investors as ”guaranteed future engagement.” The more mortgaged your attention, the more valuable you are as an asset. Because mortgaged attention is predictable. It compounds. It’s enforceable through neural architecture, not just persuasion.

This only works if the mortgage is real. If users could leave at any time without cost, there’s no guaranteed future engagement to sell. But if users are neurally mortgaged—if leaving is biologically painful, if patterns are automatic, if plasticity is declining—then future attention becomes a tradeable asset with calculable value.

Platforms don’t just make money from your attention today. They make money from the certainty that you’ll keep paying attention tomorrow, next month, next year. That certainty comes from neural mortgages.

And here’s where Portable Identity becomes nuclear:

When identity becomes portable, these neural mortgage derivatives become worthless overnight.

Because the ”guaranteed future engagement” isn’t guaranteed anymore. Users can leave. The collateral evaporates. The secondary market collapses. The entire financial architecture built on neural captivity reveals itself as a house of cards built on the assumption that users will never have sovereignty.

Portable Identity isn’t just a threat to platform revenue. It’s a threat to the financialization of neural mortgages. It’s the moment when the bank realizes the collateral they’ve been trading doesn’t actually belong to them—and never did.

This is why the stakes are higher than ”better products” or ”user experience.” This is about whether human cognitive capacity can be permanently mortgaged and securitized, or whether sovereignty remains possible.

Platforms chose mortgage. Web4 chooses sovereignty.

The Choice: Foreclose Before You’re Foreclosed On

Every day you remain in identity captivity, you’re making another payment on a mortgage you never signed.

Every notification you answer strengthens the lien on your cognitive future.

Every scroll compounds the neural debt that determines whether you’ll be able to think deeply, be present fully, create meaningfully at 40, 50, 60.

And every day past 30 that you don’t act, the biological window narrows. The plasticity declines. The mortgage calcifies into permanent neural architecture.

The bill comes due at 35 for most people. But the choice to escape has to happen now. Because by the time you notice the foreclosure, your brain has already lost the capacity to refinance.

Here’s what sovereignty requires:

Recognize you’re mortgaged. Not distracted. Not addicted. Mortgaged. The neural pathways are real. The debt is compounding. The architectural threshold is biological, not negotiable.

Understand the phase transition. If you’re under 30, you have high plasticity—the architecture is still fluid. Recovery happens fast. If you’re 30-40, you’re crossing the stabilization threshold. Change is still fully achievable but requires exponentially more sustained effort. If you’re over 40, the architecture is consolidated. Significant change remains possible, but the cost compounds annually. Prevention and stabilization become increasingly important alongside recovery.

Act before architecture becomes rigid. The neural mortgage doesn’t become impossible to escape—it becomes exponentially more expensive. And that cost increases yearly. Biology sets the interest rate, not willpower.

Demand Portable Identity. The mortgage only works if you’re captive. Portability breaks the mortgage. Not by erasing the neural pathways—they’ll take months to rewire—but by removing the switching cost that makes captivity enforceable.

Web4 is the world where neural mortgages are unenforceable. Not because they’re illegal, but because identity captivity becomes impossible.

PortableID.org/global is the protocol that makes captivity impossible. Not by changing platforms, but by making platform captivity irrelevant. When your identity is portable, platforms compete on value, not mortgage enforcement.

This is the moment. Not five years from now. Now. Because the cohort currently in their twenties is approaching foreclosure age. And the generation behind them is signing neural mortgages right now, thinking they’re just getting free apps.

The platforms aren’t going to tell you this. They profit from the architectural drift that makes captivity feel like choice. The productivity industry isn’t going to tell you this. They profit from selling you solutions that don’t address how neural architecture actually changes.

The only people who will tell you this are the ones building the alternative infrastructure that makes sovereignty architecturally possible again.

Neural mortgages were never consensual. You didn’t sign. You weren’t told the terms. You weren’t warned about the phase transition.

But you can foreclose on the lender before the architecture fully stabilizes.

Portable Identity is the foreclosure notice.

And Web4 is the world where neural mortgages are unenforceable by architecture, not by law.

The brain stabilizes around 35. Pattern becomes structure. Behavior becomes you.

But sovereignty, once portable, cannot be recaptured.

And architectural change, while exponentially costlier with age, never becomes truly impossible—only increasingly expensive.

The question isn’t whether you can change.

It’s whether you’ll act before the cost exceeds what you can pay.

Rights and Usage

All materials published under AttentionDebt.org — including definitions, methodological frameworks, data standards, and research essays — are released under Creative Commons Attribution–ShareAlike 4.0 International (CC BY-SA 4.0).

This license guarantees three permanent rights:

Right to Reproduce Anyone may copy, quote, translate, or redistribute this material freely, with attribution to AttentionDebt.org.

Right to Adapt Derivative works — academic, journalistic, or artistic — are explicitly encouraged, as long as they remain open under the same license.

Right to Defend the Definition Any party may publicly reference this manifesto and license to prevent private appropriation, trademarking, or paywalling of the terms ”attention debt” or ”neural mortgage.”

The license itself is a tool of collective defense.

No exclusive licenses will ever be granted. No commercial entity may claim proprietary rights, exclusive data access, or representational ownership of these concepts.

Definitions are public domain of cognition — not intellectual property.

neural mortgage

The Neural Mortgage: How Free Services Own Your Brain’s Future

neural-mortgage

Free platforms mortgage your brain’s future. Around age 35, the architecture stabilizes. Learn the cost before it’s too late.

https://attentiondebt.org/neural-mortgage

neural mortgage, cognitive collateral, attention bankruptcy, brain plasticity, platform captivity, portable identity, Web4 sovereignty, neural architecture